Gen Z’s drinking patterns are forcing the industry to “rapidly evolve” according to Insider Intelligence. Nearly a third don’t consume alcohol at all. But on the other hand, those who do drink alcohol, drink more often than other age groups.

Using insights from our own platform plus third-party research, Nano has uncovered four overriding trends for the alcohol and beverage industry both at present and looking forward.

- Intoxication in Moderation

Moderation and sobriety have arguably never been more high-profile trends. Alongside this, even among those who are not sober, there appears to be a growing desire to balance indulgence with moderation:

For example, as many as 55% of the UK is interested in ‘damp drinking’ also known as drinking in moderation. While almost as many, 52%, agree consuming low and no alcohol drinks has become more socially acceptable.

If more evidence were needed, Diageo is looking to invest an extra €25m in Guinness 0.0, which is predicted to result in a 300% increase in sales. Forecasts also expect their no alcohol brand will account for 10% of sales in the coming years.

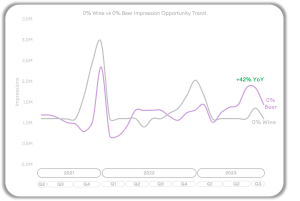

Our own data suggests a similar trend, with intent around Dry January up 46% year-on-year, comparing 2022 and 2023. However, June 2023 also saw a marked 42% intent increase, suggesting more regular consumption of low alcohol drinks outside of one limited period:

Source: Nano Interactive impression data, UK August 2023. Tesco’s PLC July 2023

Tesco’s sales data also backs the same trend, seeing 25% more sales in June than January 2023. Finally, Nano panel research from September 2023 found that younger age groups consume less alcohol than they used to, even though this wasn’t reflected among older respondents:

- 41% of those aged 25-44 said they drink up to 5 units per week, which for many is less than they did a year ago

- Older generations over the age of 45 said they typically drink 7-15 units per week, with over 53% stating they haven’t noticed a change in their drinking habits

- Around 30% of all respondents said they’ve noticed they are now drinking less, which is significantly more than those who said that they are increasing alcohol consumption

Source: UK (N=556), Nano Interactive Panel Research, September 2023

- Drinking Habits of the Physically Fit

As certain consumer groups become increasingly health conscious, there is growing demand for low-calorie alcoholic drinks.

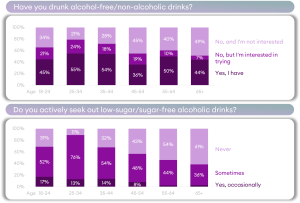

Younger age groups have already adopted alcohol-free beverages, with 45% of 18-24 year-olds saying they drink them regularly, likewise 54% of those aged 25-44, according to Nano panel data. Interest in low sugar/low calorie brands is highest among younger age groups – and in fact, decreases neatly with age:

Source: UK (N=556), Nano Interactive Panel Research, September 2023

- From Inflation to Drinkflation

The cost-of-living crisis and inflation have driven UK consumers to adapt their drinking habits, impacting both brand preferences and consumption location.

One result has been brands such as Foster’s, Heineken and Greene King have reduced the ABV content in their lager to ensure they are not forced to raise prices, in the face of tax increases. According to Nano’s own panel data, almost a quarter (23%) of consumers drank more at home in 2022-3 to save money. And a 10% increase in UK tax across spirits from August 2023 may exacerbate further the “drinkflation” debate.

Source: UK (N=556), Nano Interactive Panel Research, September 2023

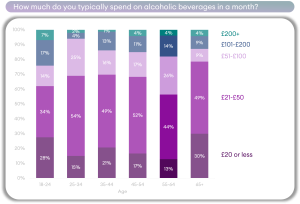

- From the above we see that 55–64-year-olds have the highest levels of alcohol expenditure with 40% spending £51-£200 per month

- Most age groups show a preference for spending up to £50 a month on alcohol

- 18-24 are more selective on when they drink, however, when they do, they spend a lot more than other generation, with 23% spending £101+

Source: UK (N=556), Nano Interactive Panel Research, September 2023

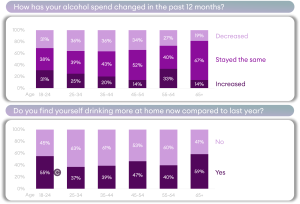

In terms of how consumption has changed in the past year:

- Alcohol spend decreased more than it increased for 25–54-year-olds

- Alcohol expenditure stayed the same more often for older respondents, likely due to greater availability of disposable income

- Conversely, 55% of the 18-24 age group who have the lowest levels of disposable income are drinking more at home

4.Novelty and Experimentation

This trend might be seen as a response to drinkflation and lower consumption – new flavours, innovation and creativity in the beverage industry.

For one example, stouts and porters surprisingly became the most produced beer style in the UK for the first time in 2022. Plus, experimental tonic brand Double Dutch have taken the market by storm with a 63% growth in 2022.

Perhaps it’s not a great surprisent “I like to try new drinks”, according to our own research.

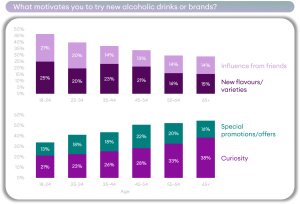

New flavours are one of the strongest ways of influencing younger generations to try new alcoholic drinks. -For older respondents, curiosity – perhaps driven by brand advertising – and special promotions are more effective in getting people to try new alcoholic drinks:

Source: UK (N=556), Nano Interactive Panel Research, September 2023

As the transition into the cookieless world approaches it’s important for advertisers to accelerate partner testing and get set up for success. At Nano, our unique live-intent targeting and contextual offering can help you futureproof your digital strategies and drive performance.

Learn how we can help by booking a demo today!