As a highly regulated industry, finance is one of a handful at the vanguard of privacy and online market changes. And of the parties currently moving us away from profiling and people-based signals, the consumer is the least considered.

And of all the parties currently involved in the industry shift that is moving us away from profiling and people-based signals, the end consumers are the least considered, but the true decision makers, and they’re voting with their thumb.

In a highly competitive market, where it’s easier than ever to switch bank or investment service, privacy and data strategies have an under-estimated impact on brand perception. Research also suggests that privacy and security are often strongly related, adding yet another reason for financial services to be ahead of the curve.

Top Finding: Gen Z Investors – Confident & Knowledgeable

- Gen Z’s financial challenges have been well documented, almost to the point of being a cliché. But less so its propensity to invest the funds it does have and how.

- This research shows it is largely not in cryptocurrency, but other categories like stocks and mutual funds.

- Gen Z’s confidence around non-pension investments is also markedly higher than any other group.

With Nano having a number of finance campaigns in our portfolio, in July 2024 we surveyed UK consumers, for a deeper snapshot of the latest trends and preferences around personal finance, and investment.

Below is just a taster of what we found – for a copy of the full research click here.

1. Investments

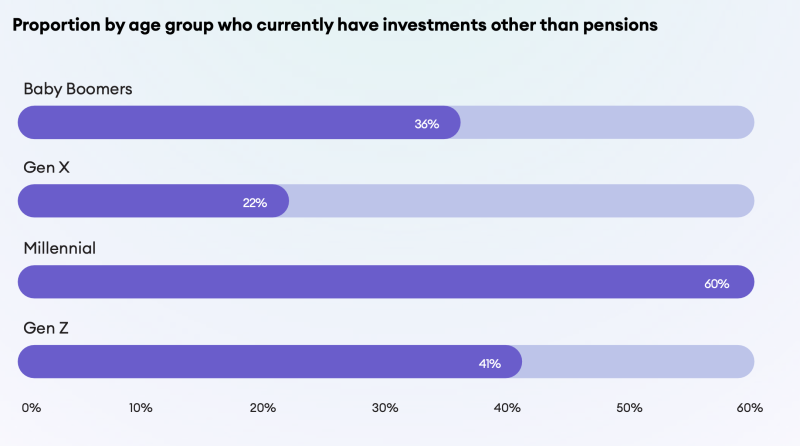

To gain a clearer understanding of the consumer investment market, Nano first asked whether panellists had any investments excluding pensions.

Gen Z and millennials are proportionally the most active investors. With 41% and 60% of Gen Z and millennials saying they have investments, versus 22% and 36% for Gen X and baby boomers, the contrast is quite striking.

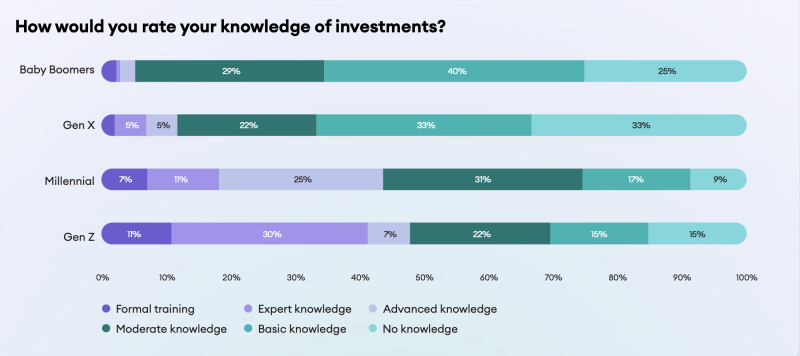

When asked to rate their personal investment knowledge, a similar pattern emerges. Gen X and baby boomers score proportionally higher for moderate, basic and no knowledge. Meanwhile, 25% of millennials questioned said they had advanced investment knowledge. 30% of Gen Z even said they were experts. Younger generations are also more likely to have had training in this area.

2. Banking

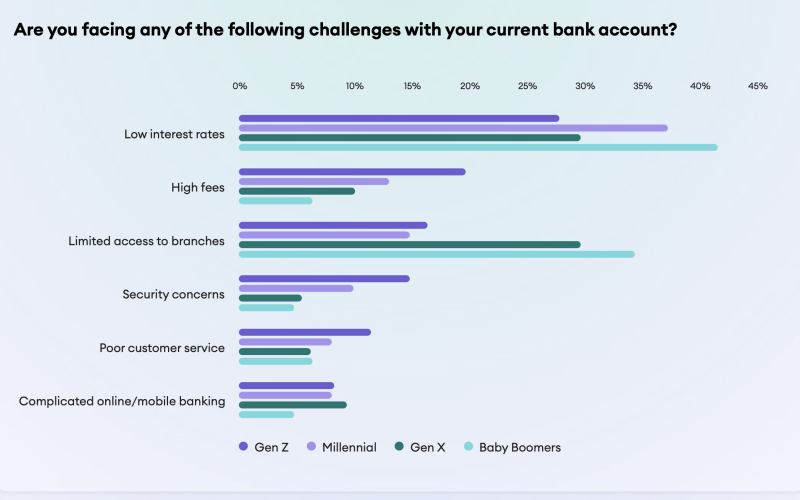

Security is a key topic for Gen Z, but only 15% are currently experiencing this as an issue with their bank. In general, this group is looking for banking solutions that merge security with low fees and quality customer support, while older generations prioritise access to branches and interest rates. Interesting how no one appears to be really struggling with online banking: younger generations are tech savvy, older generations still place more value on access to branches, even if few experience ‘complicated’ banking experiences online.

3. Credit

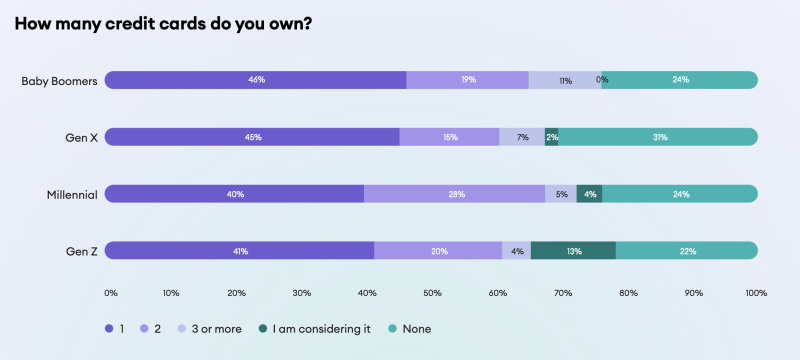

Looking within each group, proportionally millennials are more likely to have two credit cards, Gen X the group more likely to have none. Baby boomers predominantly have one – but are also more likely to have three or more.

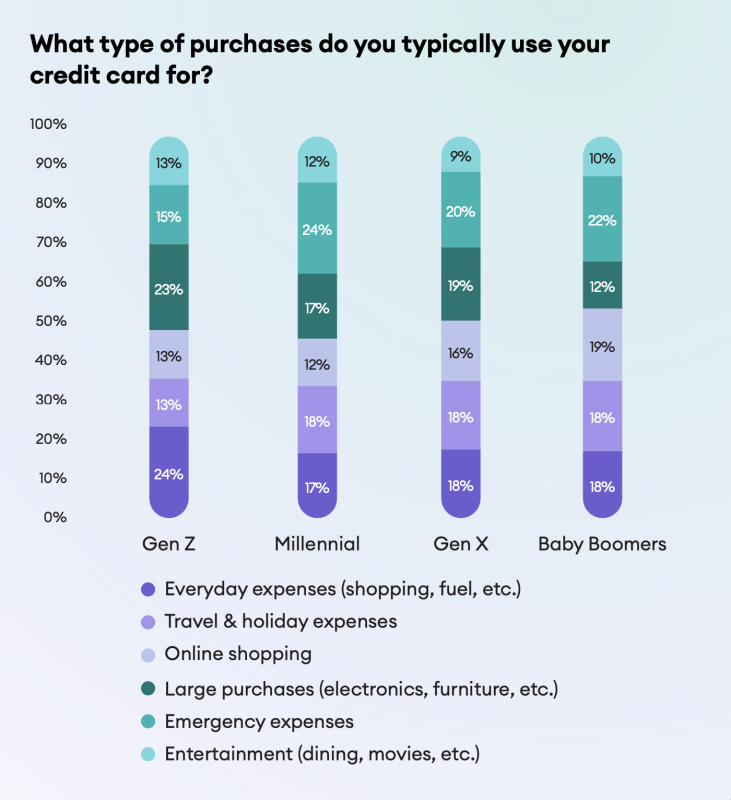

As for types of purchase made on credit, older generations seem to use them slightly more for larger purchases and holidays. Younger groups saying they use credit somewhat more for both every day and emergency purchases. But overall, what stands out on this question is the overall similarity cross-group – in other words, all four use credit cards proportionally for a broadly similar, diverse range of purchases:

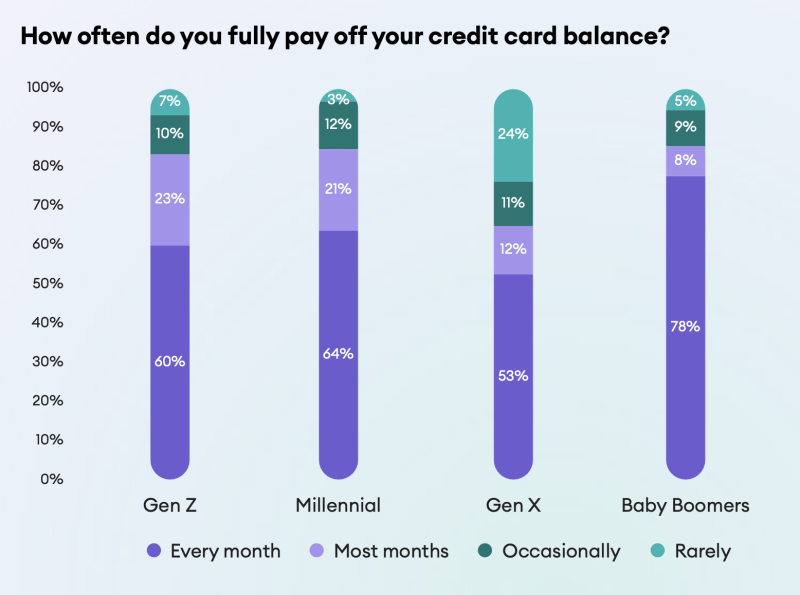

Baby boomers proportionally are most likely to pay off their credit card balance monthly. While Gen X appears most comfortable with rarely paying credit off in its entirety. On the whole however, the vast majority does still pay it off on a regular basis.

What Next? From Report Insights to Specific Tactics

- While traditional banks still make up most of the market, new brands are entering, offering new services and products that benefit younger consumers

- Target content mentioning or related to banks new services and products highlighting key benefits

- Most consumers looking to open a new account are millennials and Gen Z

- Target using Nano’s Gen Z Intent Persona with content relating to the benefits of switching or opening a new bank account, highlighting offers and incentives.

Access a copy of the full research ebook here.

For guidance and tips on how to activate and optimise your campaigns based on the insights please contact our Client Success team at clientsuccess@nanointeractive.com.