The impact of consumer tech trends is easy to understate. Lest we forget, the smartphone’s rise upended countless industries, including media and advertising itself. As if transforming shopping or leading the rise of social media wasn’t enough, mobile arguably even ended up defining a whole generation, for better or worse.

While there may not be anything quite so earth shattering on the consumer tech horizon in 2023, our insights team has identified five major trends to help agencies and brands’ decision making in what is still a fascinating, fast-moving space.

It should be added that these are in turn all informed by three macro behavioural trends – comfort seeking, rising health crises and economic uncertainty.

1. Impact of AR/VR

Virtual reality is by no means a new idea – with VR consumer devices stretching back to Nintendo’s Virtual Boy in 1995. But even 30 years later, the iPhone of headsets still eludes us.

While Meta’s Oculus has made VR more mainstream, an Insider Intelligence/eMarketer report on the sector suggests that

The predominant use cases are more limited for VR than for AR… VR will attract nearly 4 million new users in 2023, but that won’t be enough to keep the gap between VR and AR users from growing.

And in analysing Nano’s own platform intent data, it seems both AR and VR are still on the rise, as principally a method of enhancing both gaming experiences and fitness goals.

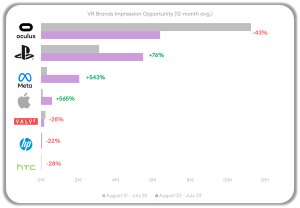

Source: Nano Interactive impression data, UK 12-month avg.

The swing between Oculus and Meta intent may be largely explained by the parent company’s renaming of products. New Oculus products have been rebranded with the parent company’s name, but the legacy name still holds weight. And it continues to drive the most impressions in the VR space. We also see an indication here of Playstation’s impact on the sector since launching its VR2 headset in February 2023.

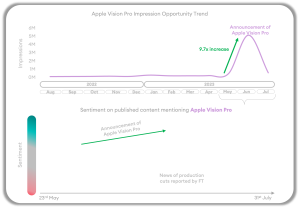

Apple’s unveiling of its Vision Pro device in May 2023 brought a big spike in interest for VR – as its product announcements usually do.

We saw around a 10x increase in impressions following the announcement of the Apple Vision Pro, however, Nanos technology can also track sentiment overtime, which highlighted a positive uplift that continued for a month proceeding the announcement. Impressions only seem to have taken a hit after the financial times released an article mentioning the tech giant may have supply issues.

However, the rumoured high price of Apple’s device, at around $3,000 suggests it is unlikely to be on everyone’s Christmas list, at least in the short term. And even more so if its rumoured release date of early 2024 is the case. It will be interesting to see if that initial spike in interest lives on.

Source: Nano Interactive impression & sentiment data, UK August 2023

2. Digital Wellbeing

Second under our macro trend of seeking comfort from consumer tech comes digital wellbeing.

Awareness of screentime and the impact of phone addiction are on the rise post-pandemic, with some consumers concerned about heavy usage. According to a Canvas8 report from June 2023, as many as 50% of Gen Z would like to reduce their screen time.

Responding to this trend, we see the emergence of a new smartphone from Nothing which has a monochrome screen – the theory being that removing colour makes the device less addictive. Another similar offering is the Light Phone, billed as a “premium, minimal phone” with music and maps, but no “anxiety-inducing infinite feed.” Elsewhere, there are stories of trendsetting influencers and celebrities adopting ‘dumb’ flip phones, especially when on nights out.

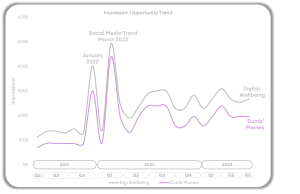

It’s interesting to note also that interest around ‘dumb’ phones chimes with overall digital wellbeing and ‘new year, new you’ demand. The March 2022 spike seen in the chart below correlates to a specific period of the above-mentioned influencers promoting this device type:

Source: Nano Interactive impression data, UK August 2023

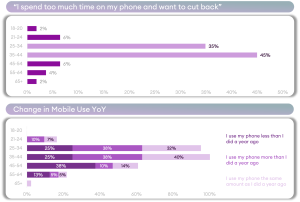

Nano’s own research suggests the 25-44 group especially growing concerned with mobile screentime and keen to cut back:

Source: UK (N=220), Nano Interactive Panel Research, August 2023

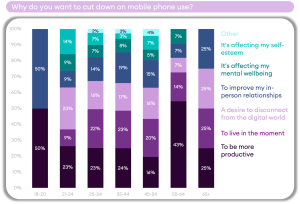

When asked the main drivers for cutting back on mobile use, nearly all groups cite making more productive use of their time – either ‘to live in the moment’, or ‘to be more productive’.

14% of the 21-24 age group thought their mobile use was affecting their mental health and driving mobile detox – the highest across the board.

Source: UK (N=220), Nano Interactive Panel Research, August 2023

3. Tech for the Time Poor

The last entry under the ‘comfort seeking’ tech macro trend is that of time poor professionals looking for new ways to save time. Specifically, by automating everyday tasks at home, partly against a background of a greater focus on cleanliness post-Covid.

According to a Canvas8 poll in June 2023, 56% of respondents said they clean surfaces more than before the pandemic, because of more time spent at home. 78% said their wellbeing ties in directly to the cleanliness of their home.

Meanwhile, by 2025 Dyson has said they will be investing $3.7bn in automated cleaning products, including vacuums, mopping robots and purifier devices.

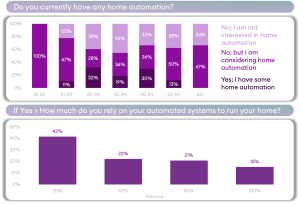

Though almost a third of 25-34 and 45–54 year-olds already use home automation, two-thirds of 21-24 year olds don’t currently, even if they would like to. The second chart below seems to show there is still much room for automation to grow in terms of helping with manual tasks – with more than 40% saying devices only cover a fifth of the tasks at hand:

Source: UK (N=220), Nano Interactive Panel Research, September 2023

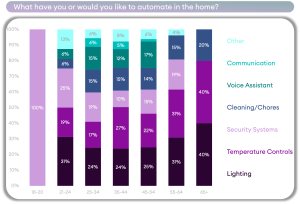

Broadly speaking, younger respondents seem more interested in home security, and a broader range of different automation types. Older age groups tend to favour simpler, more established options such as lighting and temperature controls:

4. Evolving Health Tech

As healthcare concerns become increasingly less manageable by public healthcare systems in some countries, consumers are turning more to health tech to help manage their health independently.

46% of Americans say they use at least one type of consumer health care tech in 2023, according to a MedTech Dive survey in June 2023. Meanwhile, India’s wearables segment grew 56% year-on-year, largely due to the growth of the BoAT brand, which offers a range of devices including a smart ring that measures both activity and sleep.

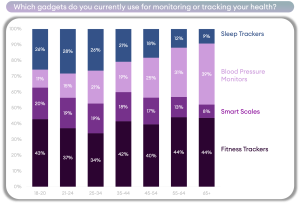

Source: UK (N=541), Nano Interactive Panel Research, August 2023

Fitness trackers are the most established health device type across all demographics. Younger age groups are most interested in improving their sleep with the help of wearables, while those aged 45+ show increasing interest in medical grade health gadgets like blood pressure monitors.

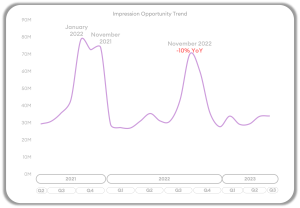

Demand for smartwatches and other health tech devices peaks in November, aligning with peak gifting and winter sales season. A second, lesser peak in January links to post-Christmas health drives and new year’s resolutions:

Source: Nano Interactive impression data, UK August 2023

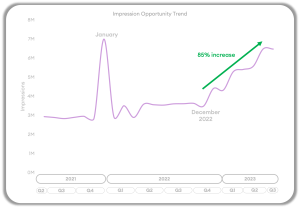

Similarly, interest in health tech that monitors blood pressure, sugar etc. normally sees a clear peak around January. More recently however, this area has seen continuous growth since December 2022, peaking in July. Could this be related to ongoing news of challenges faced by the NHS and other public healthcare systems, and people increasingly monitoring and diagnosing their own health problems?

Source: Nano Interactive impression data, UK August 2023

5. Tech for Rent

Since the cost-of-living crisis hit our pockets, saving money is obviously a priority. With spending less money on electronics than a year ago, it seems some of that spend is going instead to what might be termed the Airbnb of consumer tech – renting for a limited period, instead of owning a device.

While for comparison, demand around content relating to recycling or sustainability has dropped from 2021 to 2023, intent linked to ‘renting electronics’ is up 75% year-on-year, according to Nano’s own data.

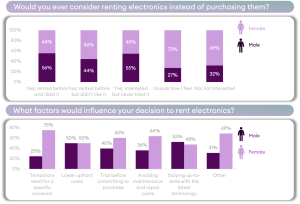

Overall, men are more open to the tech rental trend than women it seems, with 41% saying they have tried it and enjoyed the experience. Women are more likely to rent electronics to fulfil a temporary need while men are attracted to its lower upfront costs and staying up to date with the latest devices:

Source: UK (N=223), Nano Interactive Panel Research, September 2023

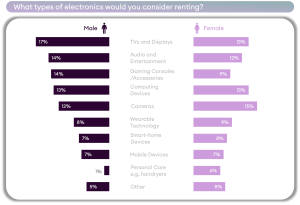

When asked what type of tech they would consider renting, men favour entertainment – TVs and displays, audio and gaming. Women are more likely to choose cameras, then computers, wearables and smart home devices:

Source: UK (N=223), Nano Interactive Panel Research, September 2023

As the transition into the cookieless world approaches it’s important for advertisers to accelerate partner testing and get set up for success. At Nano, our unique live-intent targeting and contextual offering can help you futureproof your digital strategies and drive performance. Learn how we can help by booking a demo today!