Last month, we shared the results of Nano’s research, showing the cost-of-living crisis’ impact on British Muslims and their plans for Ramadan. It was covered in the Mirror, Al Jazeera, WARC and beyond.

As we move towards the end of the month’s fasting, marked by Eid at moonrise on 21 April, we share some of the other learnings from our survey of a representative UK sample of 236 people.

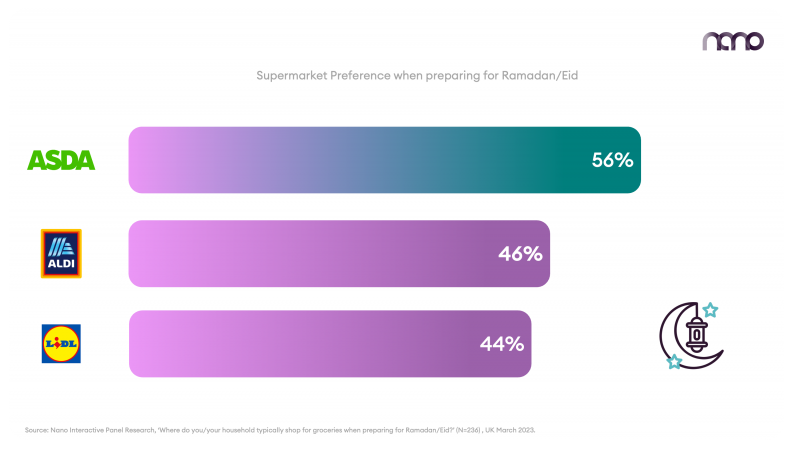

Almost two-thirds (62%) of UK Muslims said that they plan to visit friends and family for Eid celebrations. But while get-togethers on this annual event may be no less important, in the face of economic challenges, where you shop is in the spotlight. More than 40% of UK Muslims are turning to budget friendly grocery stores such as Lidl (44%) or Aldi (46%) when preparing for Ramadan/Eid. Even more however (56%), interestingly, showed a preference for Asda.

When it comes to buying gifts for Eid, our survey also found:

- 42% of UK Muslims expect to spend less than £30 per person on Eid gifts this year, with 61% of those saying that this is much less than they spent last year.

- 47% of UK Muslims said they plan Eid gifts for friends and family months in advance and put money aside for this.

- While 38% of UK Muslims are more likely to factor in their current budget closer to the festive period when planning those same gifts.

But the news is not all negative. According to the research, almost half – 44% of UK Muslims describe themselves as brand loyalists – typically purchasing brands they know and love.

This may be reflected in this group’s preference for Asda, as referenced above. Data from Statista confirms the same. Asda have typically paid careful attention to creative messaging around Ramadan over the years and always have special offers closer to the time. It is likely therefore that this brand loyalty has developed over time as the chain is one of the only supermarkets specialising in a wide variety of ethnic foods.

Those businesses who continue to focus on brand awareness – who nurture audiences, investing in consideration, and preference alongside direct short-term results, seem most likely to emerge from the current economic challenges, and best placed to profit from future growth.